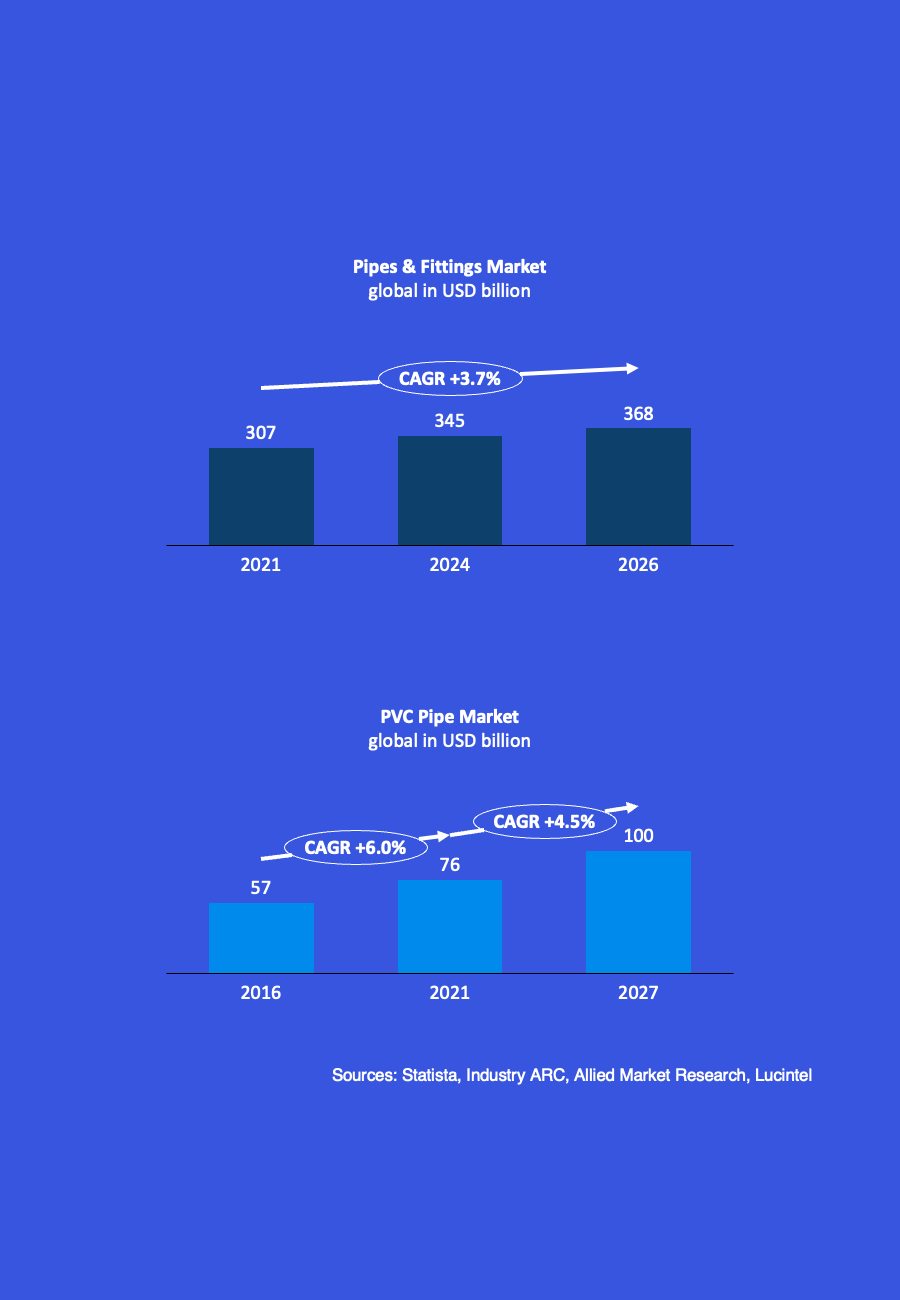

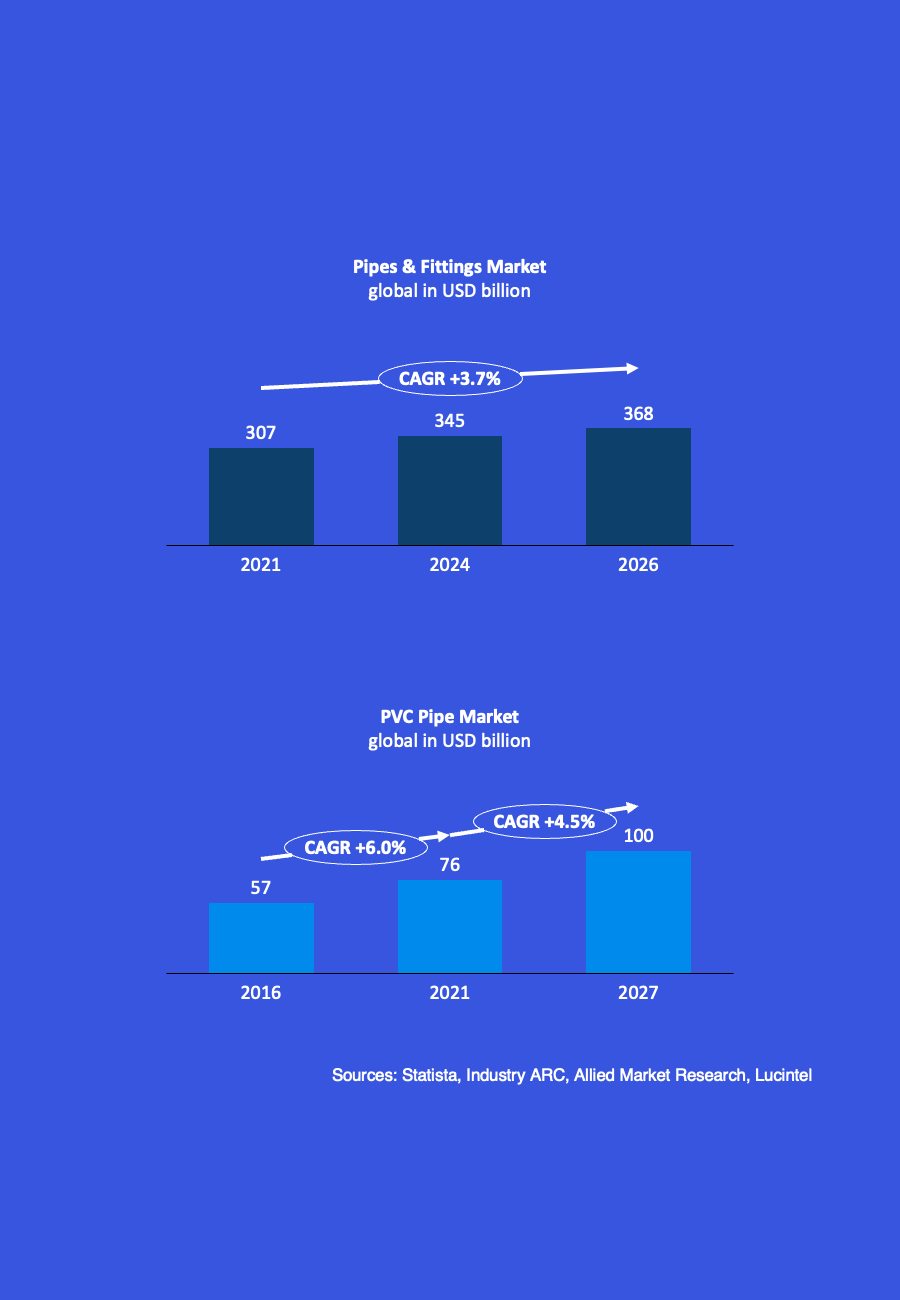

The Pipes & Fittings Market Size is forecasted to reach $367.9 billion by 2026, at a CAGR of 3.7% during 2021-2026 majorly driven by rapid urbanization, government investments towards infrastructural growth owing to which there is a requirement of pipes for water distribution systems. The demand for high performance corrosion resistant steel and plastic pipes has been driven by large scale inter regional oil and gas projects. Adoption of steel pipes and fittings by various industries such as Chemicals & Petrochemicals, Mining and others as they are corrosion resistant will help the market to rise significantly in the forecasted period.

LATEST TRENDS IN THE INDUSTRY

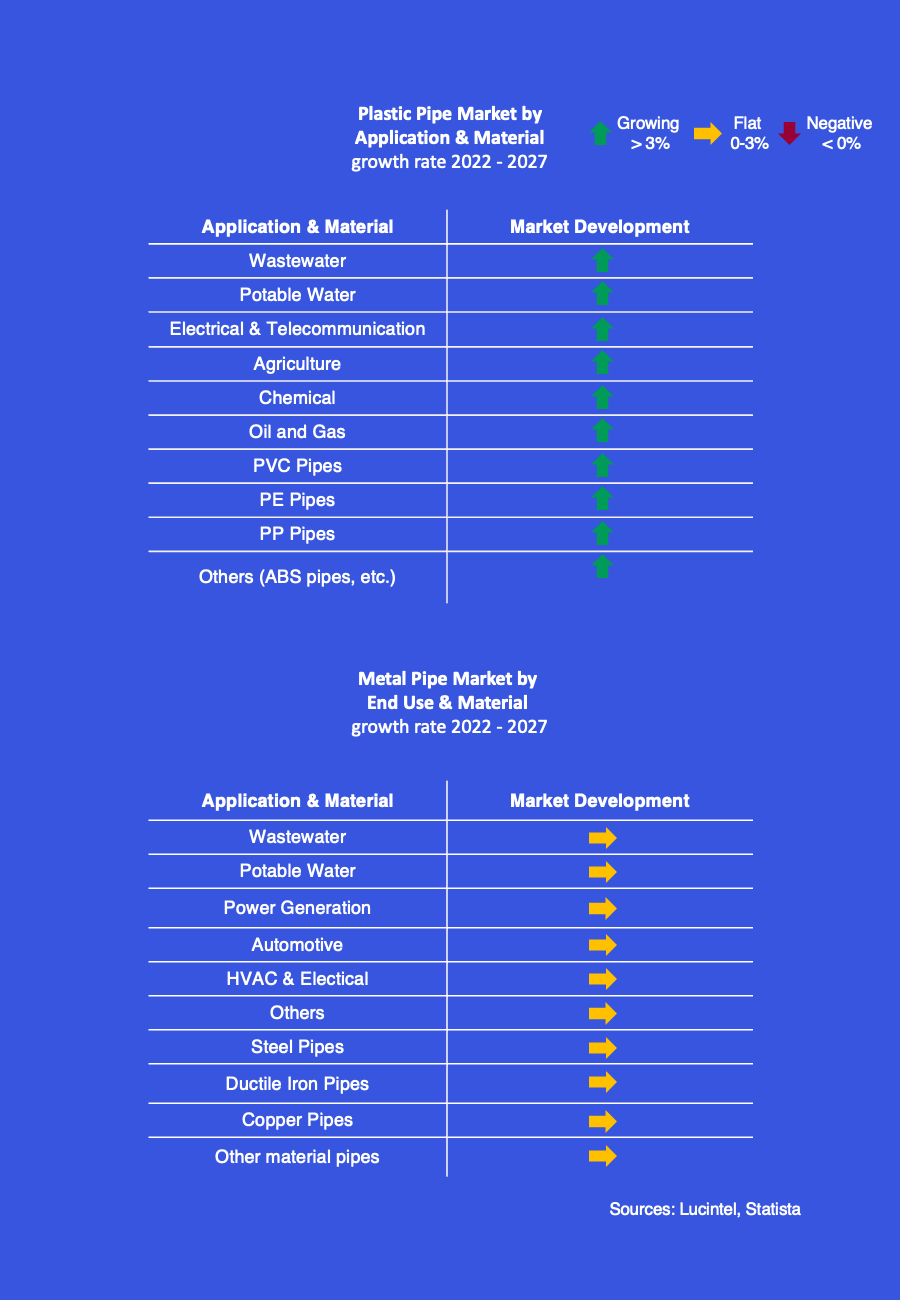

Growing Demand for Durable Piping Systems to Expand Avenues as well as Pre-Insulated Pipes – Consumers in the plumbing fittings market are increasingly adopting pipe fittings that are durable and cost-effective. A slew of functional attributes related to corrosion resistance have bolstered demand for these products in industrialised nations for both new constructions and renovations. Of note, the demand among homeowners is likely to generate lucrative opportunities for firms in the plumbing fittings market. Likewise, especially the pre-insulated pipes show a strong growth driven by the district heating investments.

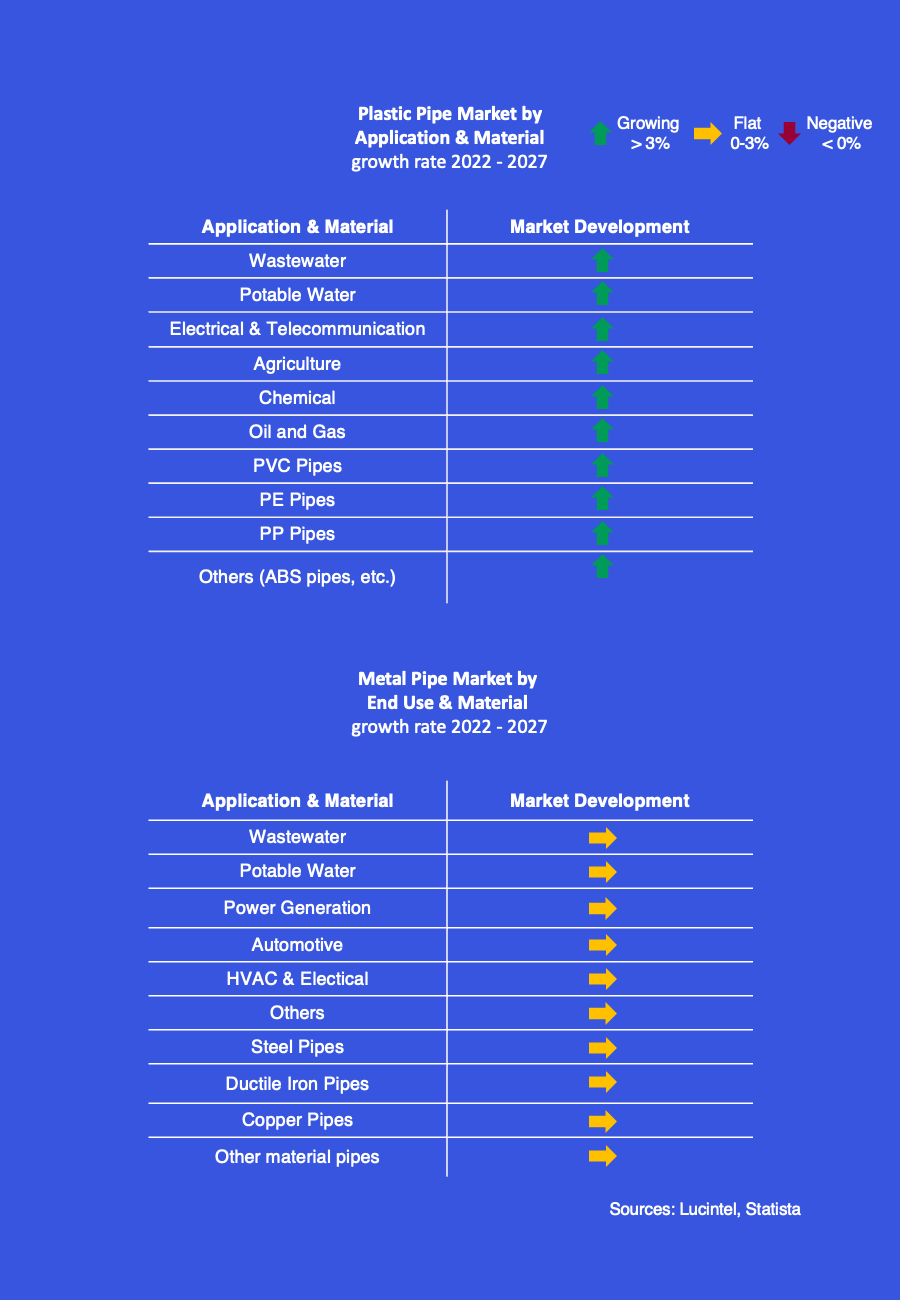

Adoption of Metal Pipes to Generate Substantial Revenues – Out of the various materials, metals held the major plumbing fittings market share in 2021. Nevertheless, the focus on durability has been driving preference from metals toward pipes and fittings made of polymers, such as the adoption of PVC and PEX piping fittings.

Rise in Residential & Non-Residential Projects in Industrialised Nations to Propel Revenue Growth – Over the past few decades, industrial nations have witnessed rise in urban population. This trend is likely to continue at least until 2040. This inevitably will invigorate residential constructions, which will stridently spur the demand for plumbing pipes and fittings. Furthermore, straining public health systems will impel investments on new construction projects by various governments. The demand for plumbing piping systems will thus gain a robust fillip, which will expand the revenue potential of the plumbing fittings market. However please note, that the demand in the residential industry was rather weak in the last quarter due to the economic uncertainty. This causes many to wait with new investments.

Further consolidation within the Pipes & Fittings Market – The market has seen a significant increase in mergers and acquisitions driven by the largest players (Orbia, Rehau, Aliaxis, etc.) over the last few years which is likely to continue in the future.

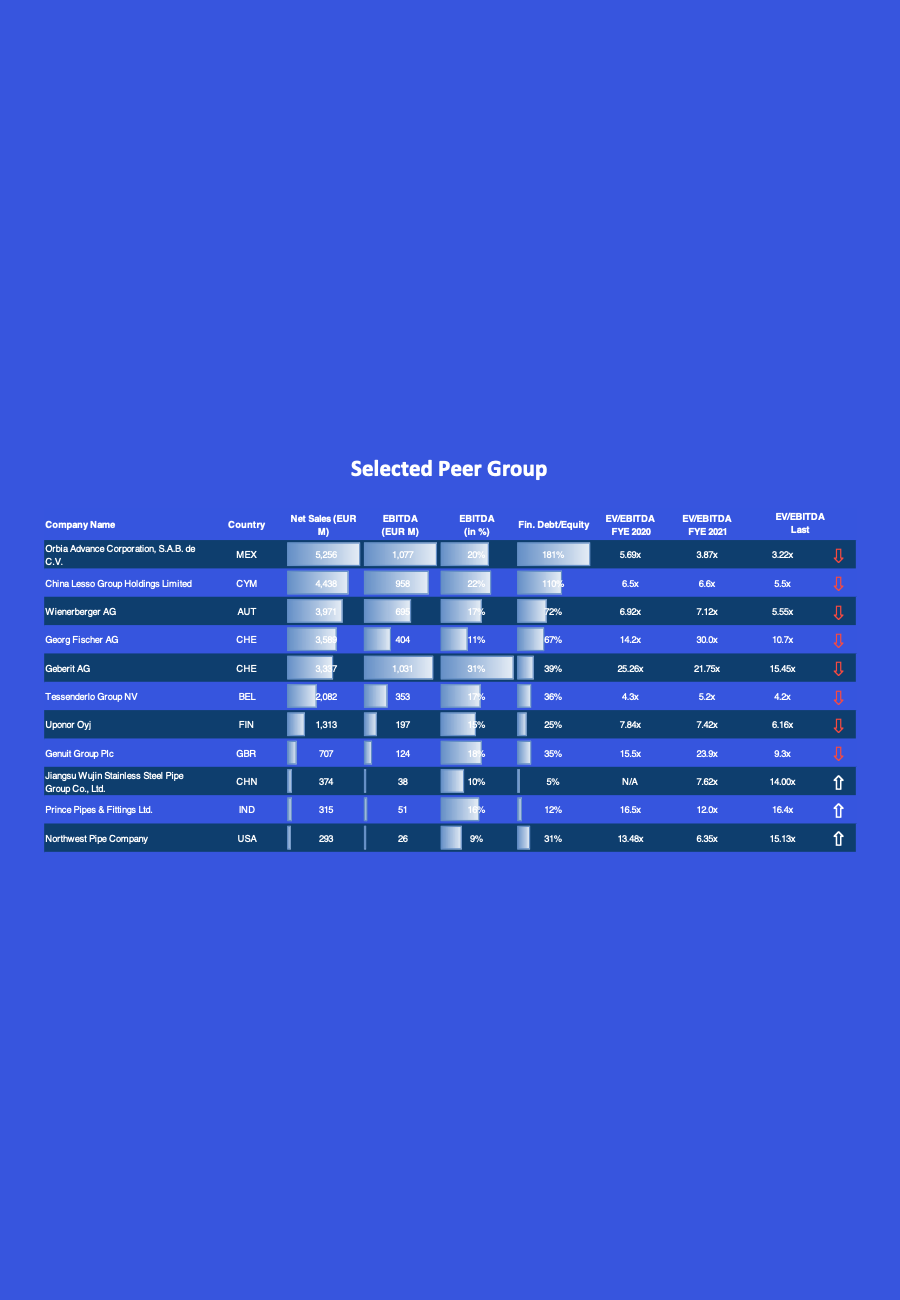

VALUATIONS PIPES & FITTINGS MARKET

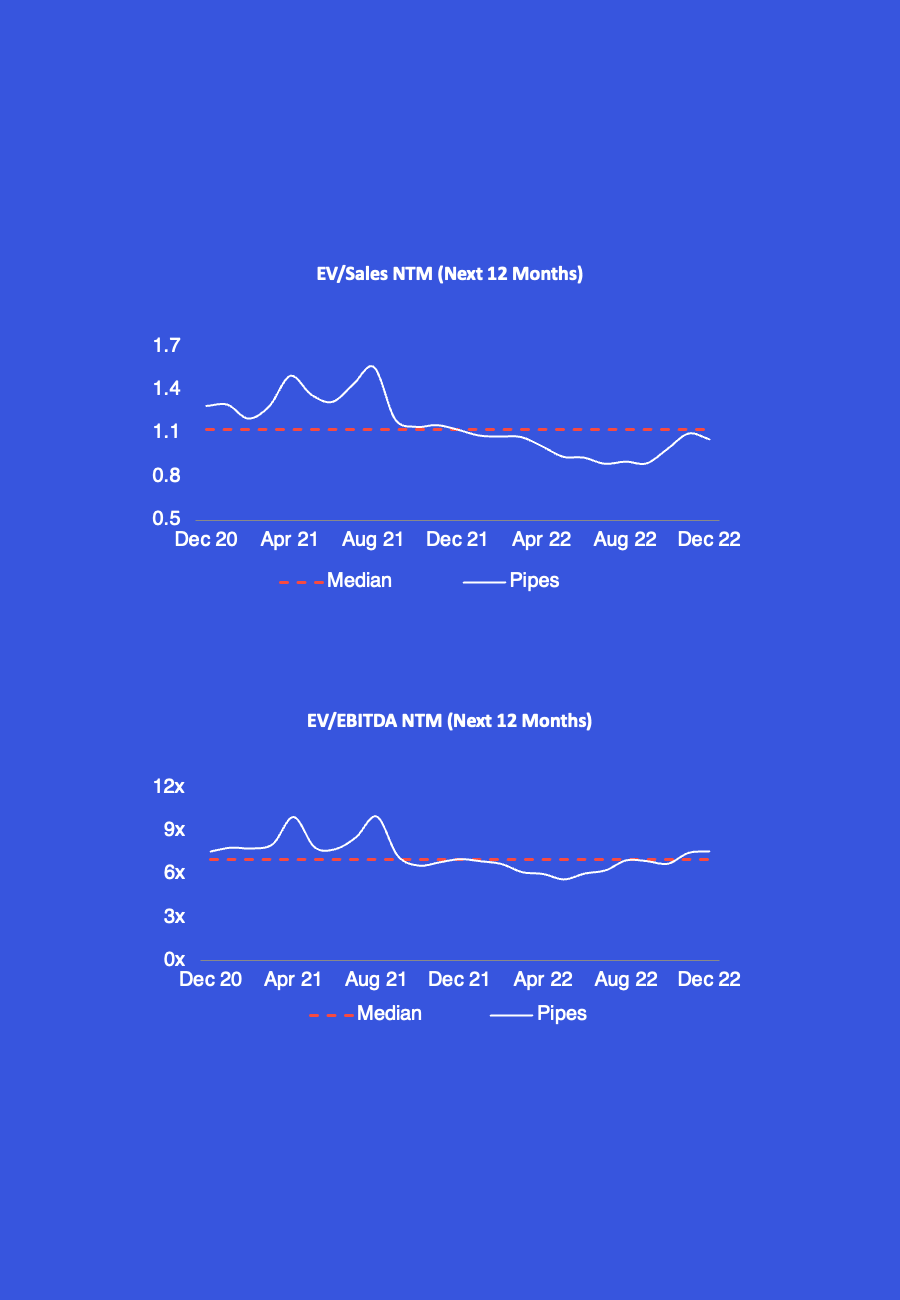

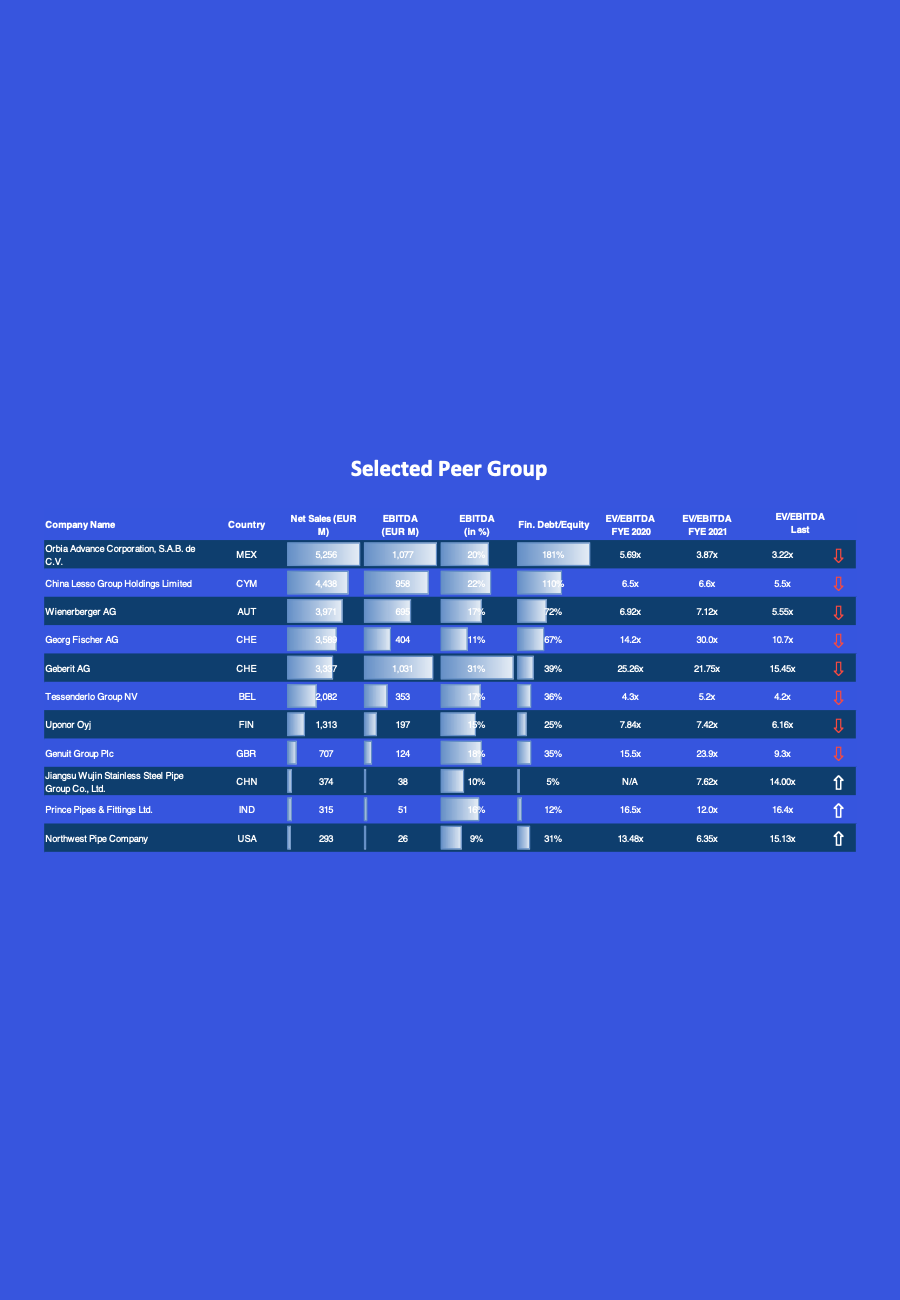

- The peer group consists of stock-listed companies in the pipes & fittings industry. Furthermore, it is noticeable that there are very high variances between the individual companies.

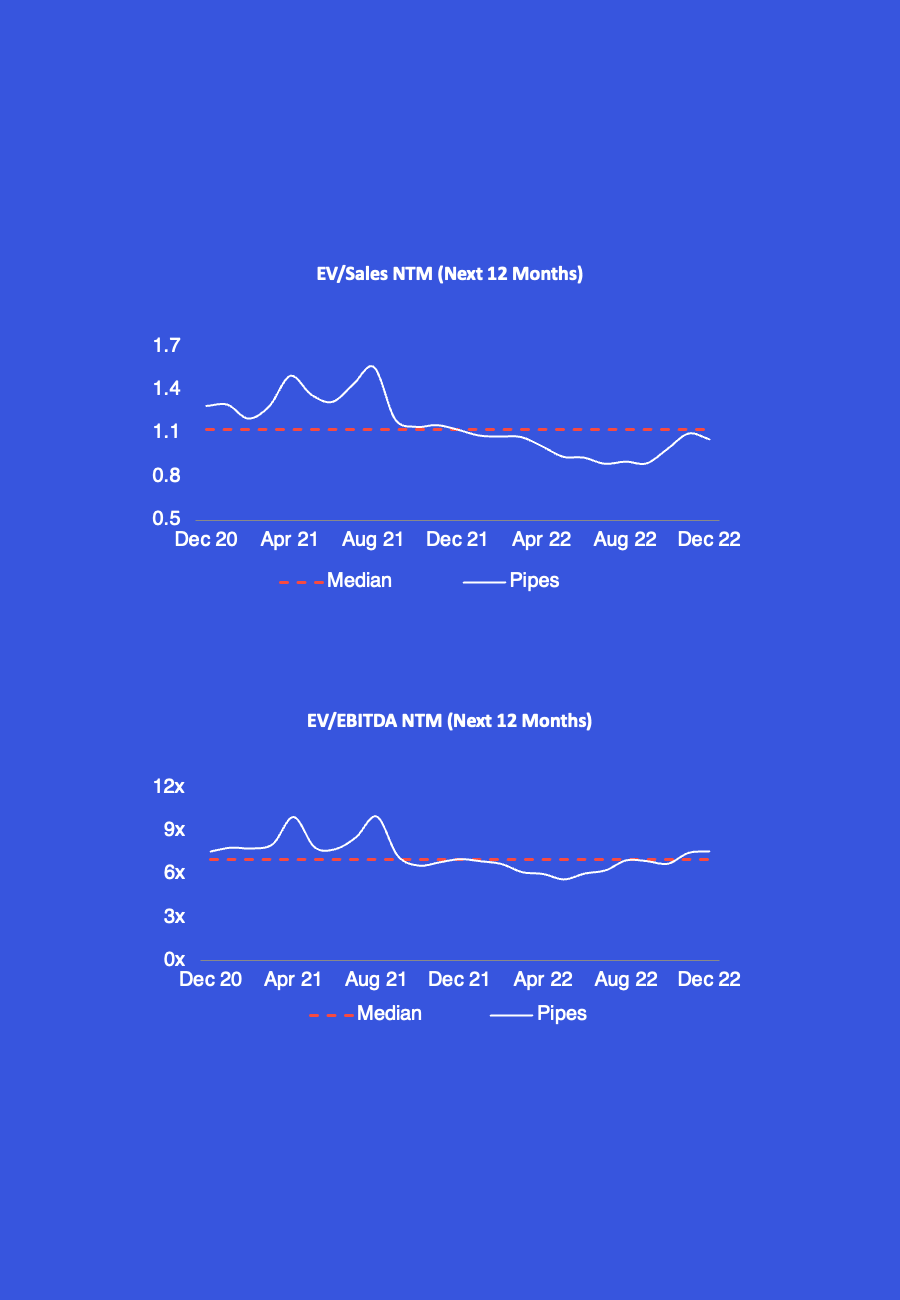

- EV/SALES (NTM) multiples have increased significantly up to a median valuation of 1.5x in Q2 2021 - however, most recent expectations show a downward trend with a slight recovery towards the end of 2022. Likewise, multiples between 6-8x can be observed in the SME sector.

- EV/EBITDA (NTM) reached a 2-year high in Q1 and Q2 2021, but since then decreased steadily and stabilized at around 7.1x times.

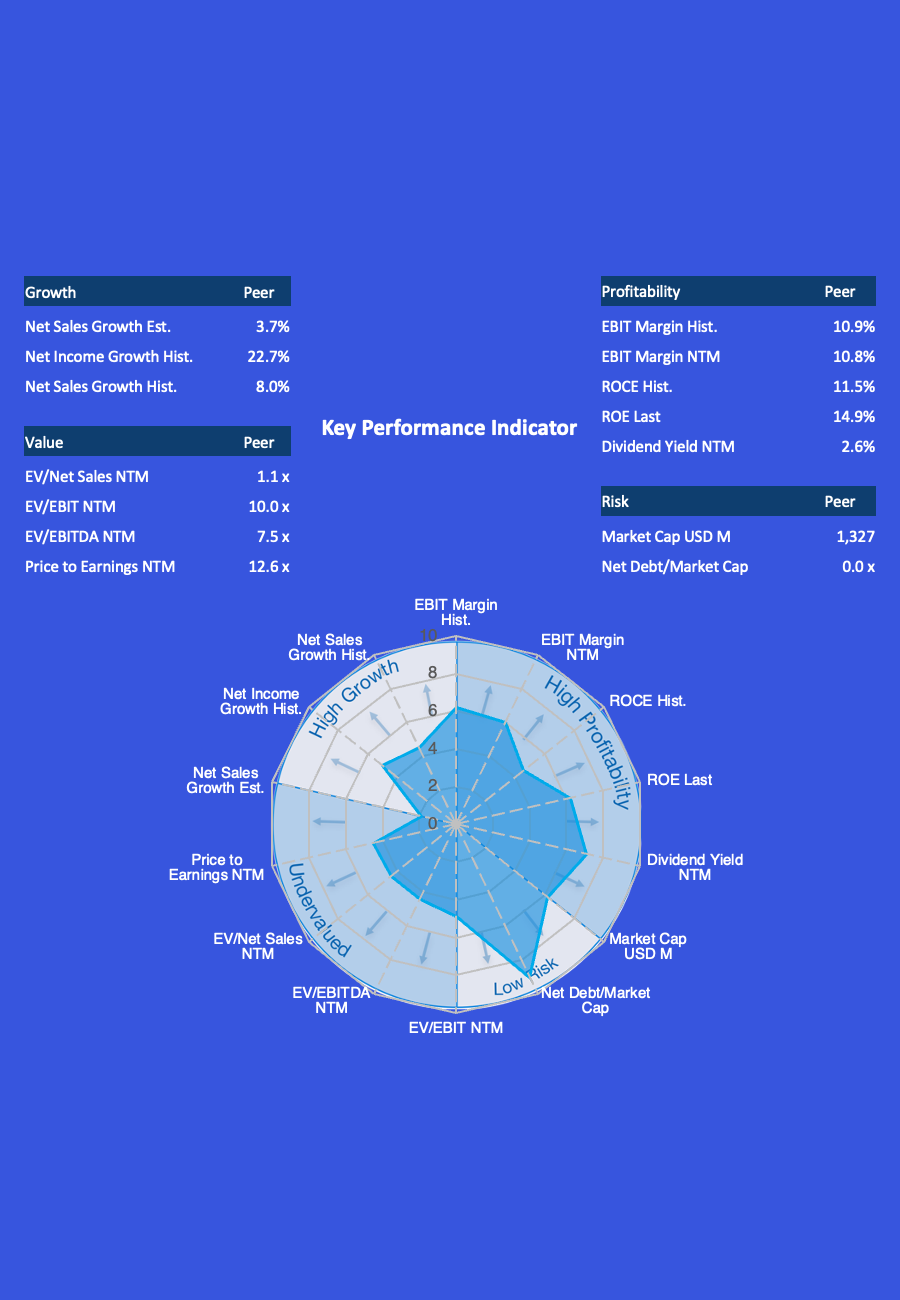

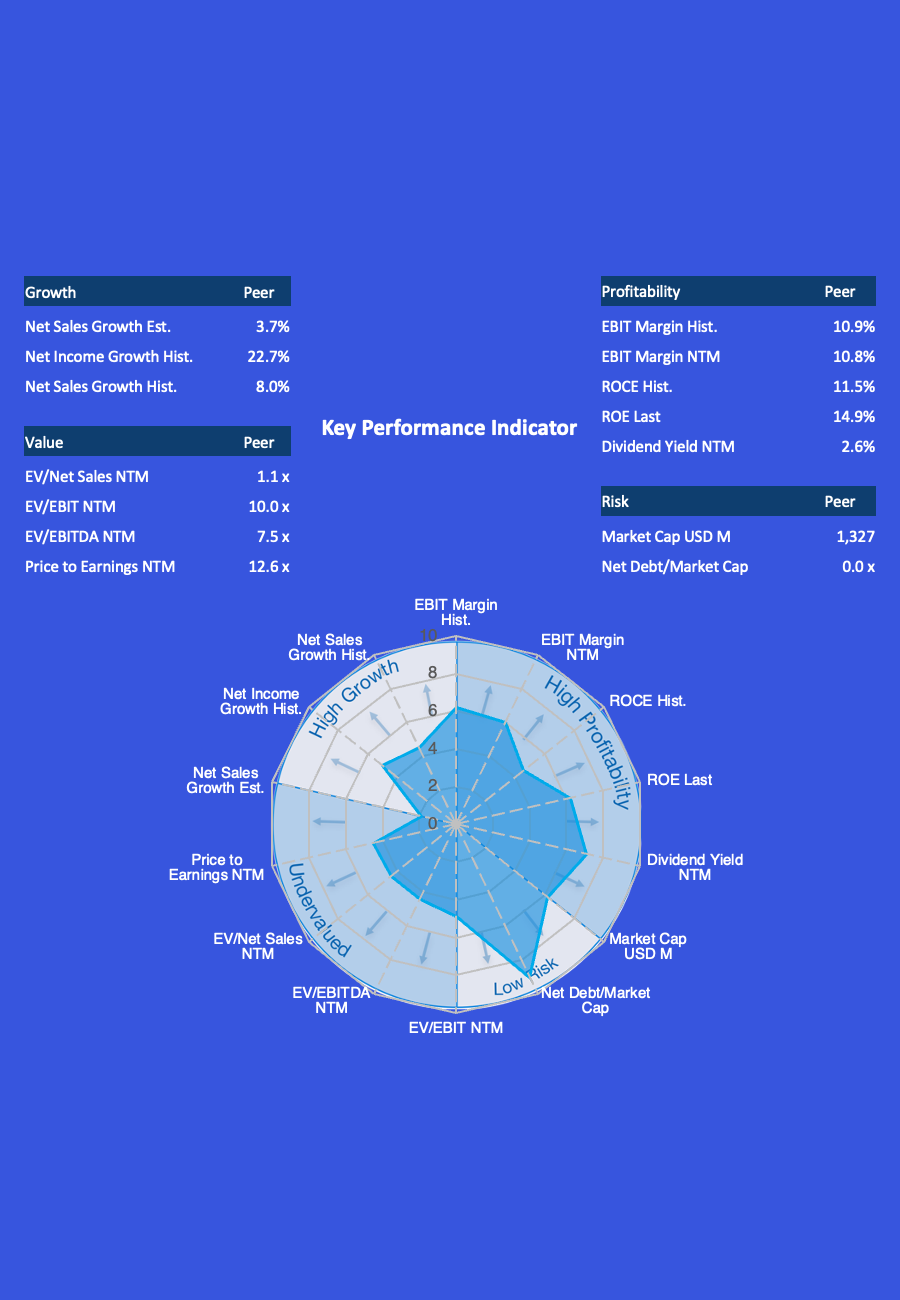

KEY PERFORMANCE INDICATORS

PEER GROUP ANALYSIS

M&A TRANSACTIONS

WANT TO KNOW MORE?

If you would like to learn more about the valuations and deals of your industry, the transaction mentioned above, or generally our way of working, we would certainly be happy to demonstrate our m&a PLUS® principle in a confidential meeting. Just get in touch and we will share our experience on how to grow businesses with long-lasting partnerships.