GLOBAL MARKET

- The chemicals business confidence has picked up in recent months with expectations for a mild recession and moderate growth for the industry. However, managers are still uncertain about the upcoming demand when assessing their order books and inventory levels, as the latter is currently perceived as still too high. Furthermore, growth prospects for chemical producers serving interest rate sensitive sectors are expected to be slightly more hampered.

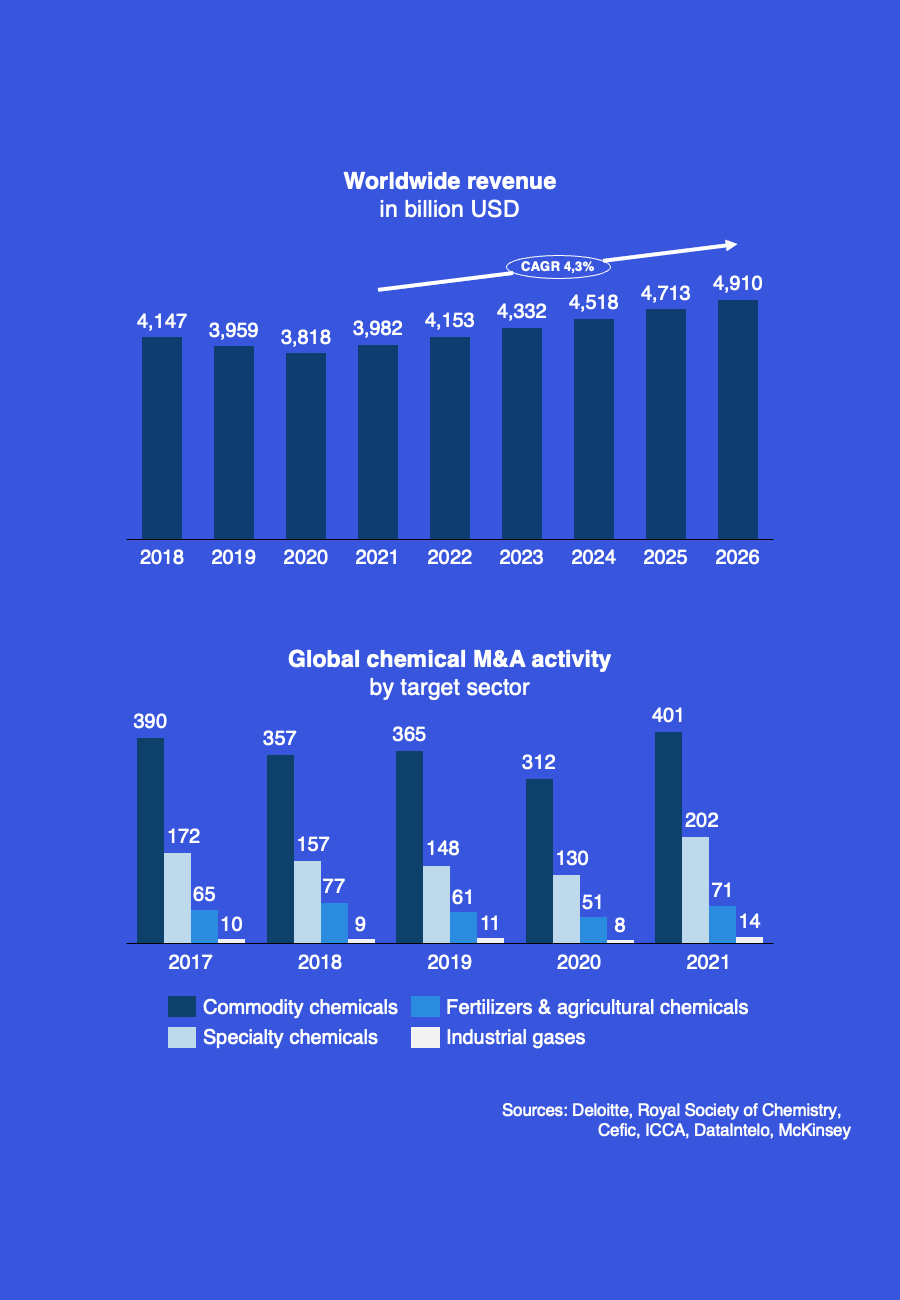

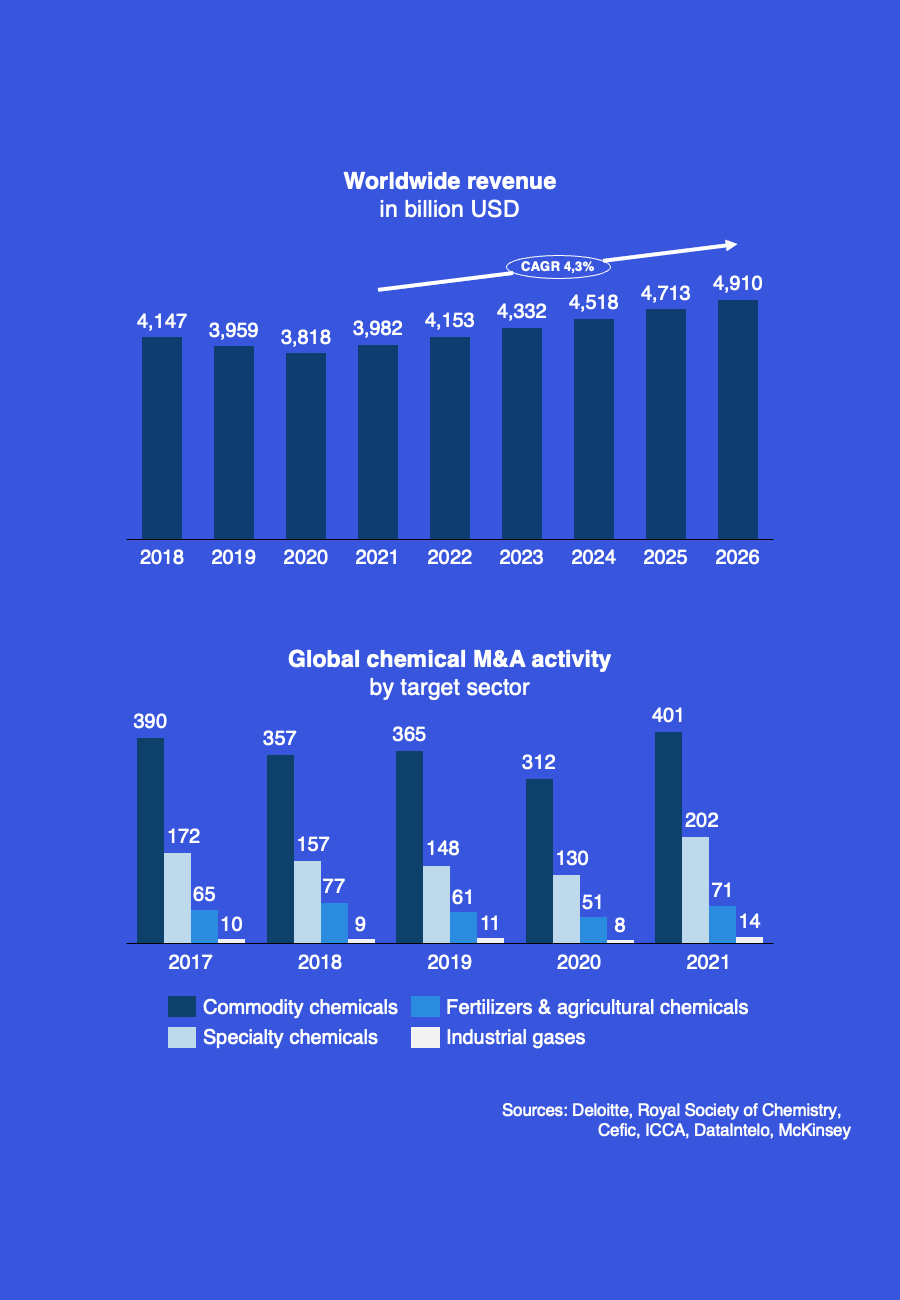

- oStrong M&A activity in the chemicals industry continued in 2022 — with a push towards building more focused portfolios, abundant dry powder from private equity funds, a favorable economic backdrop in many global economies, and chemical companies in search for growth. The energy transition, and the move toward decarbonization and a more circular economy, are also bound to rise in focus as chemical companies shape their M&A strategies for 2023 and beyond.

LATEST TRENDS IN THE CHEMICAL INDUSTRY

- Chemical companies are likely to leverage digital technologies to enable automated trend sensing and social media scanning (using text analytics) to identify broader market trends and customer requirements. This customer-centric innovation, which solicits real-time feedback through customer engagement tools, could help improve the scope, scale, and returns of R&D efforts.

- In the past, chemical businesses have typically implemented advanced data analytics and digital initiatives in silos, resulting in slower processes, higher costs, and uncertain benefits. However, chemical firms are now increasingly realizing that digital transformation is about implementing more and better technologies and involves aligning culture, people, structure, and tasks.

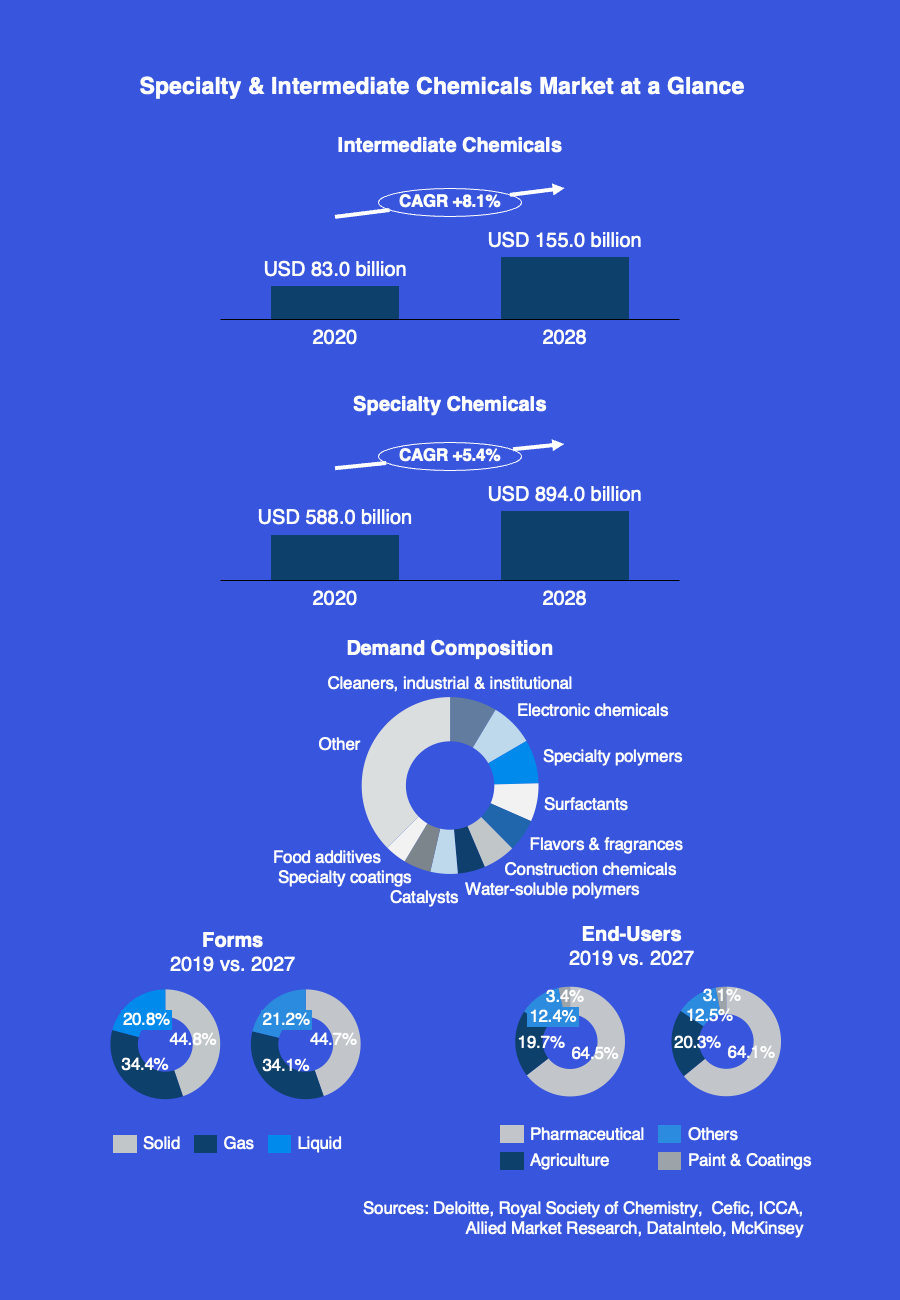

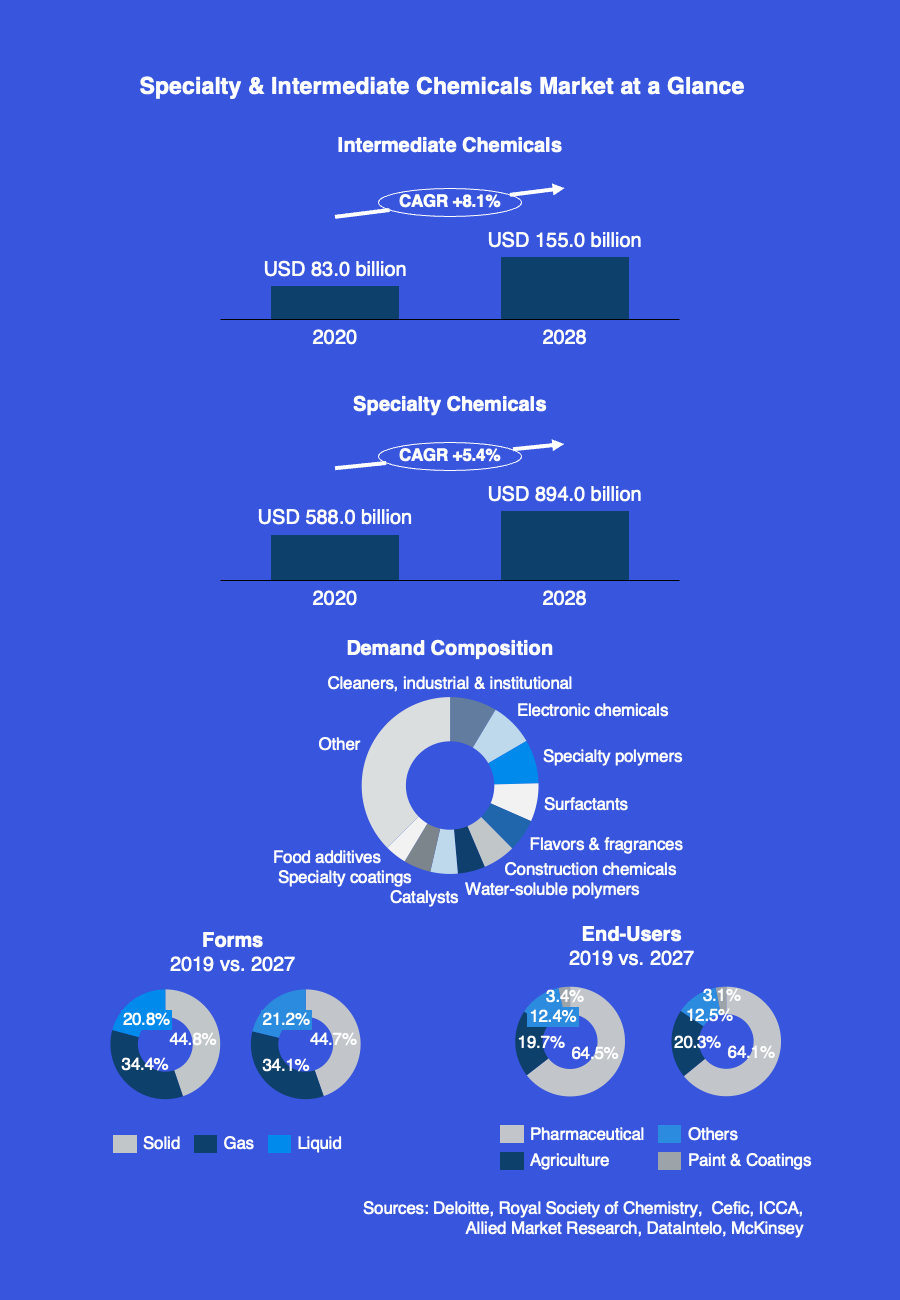

- The rising concerns about the harmful effects of conventional chemicals on the environment have led to an increase in the demand for user- and environment-friendly specialty chemicals. As a result, leading players are focusing on the development and marketing of specialty chemicals in these variants to expand their product portfolio and improve their overall sales. These players are also investing in research and development activities to provide innovative and custom-made specialty chemicals for target applications.

- As the supply chain crisis has affected almost all industries across the globe including chemical manufacturers, 2023 will be a crucial year to revaluate current supply chain structures in order to be optimally positioned for the time ahead marked by challenges such as balancing costs, minimalizing the carbon footprint of business operations and resiliency against future disruptions.

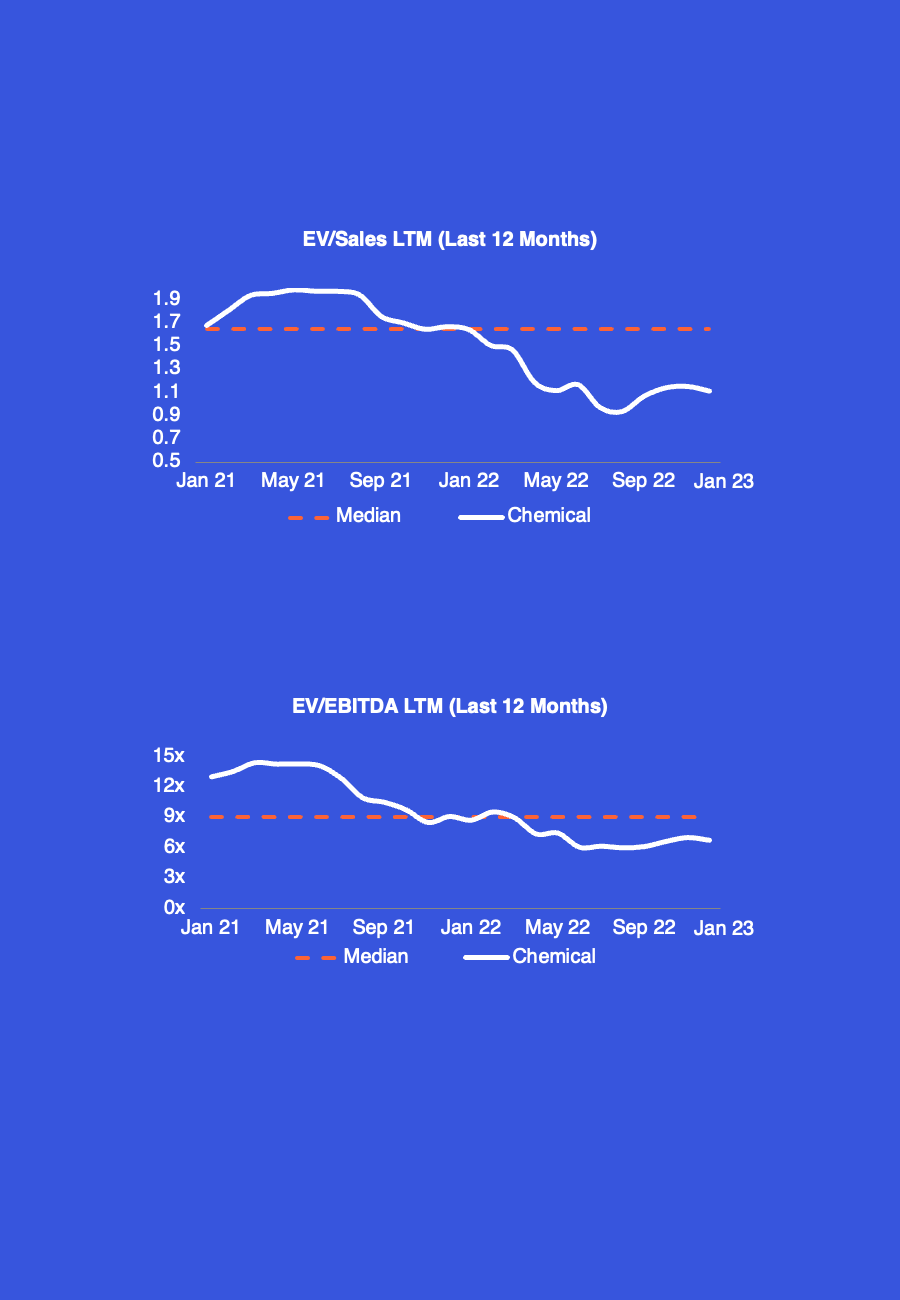

VALUATIONS CHEMICAL MARKET

- As the supply chain crisis has affected almost all industries across the globe including chemical manufacturers, 2023 will be a crucial year to revaluate current supply chain structures in order to be optimally positioned for the time ahead marked by challenges such as balancing costs, minimalizing the carbon footprint of business operations and resiliency against future disruptions.

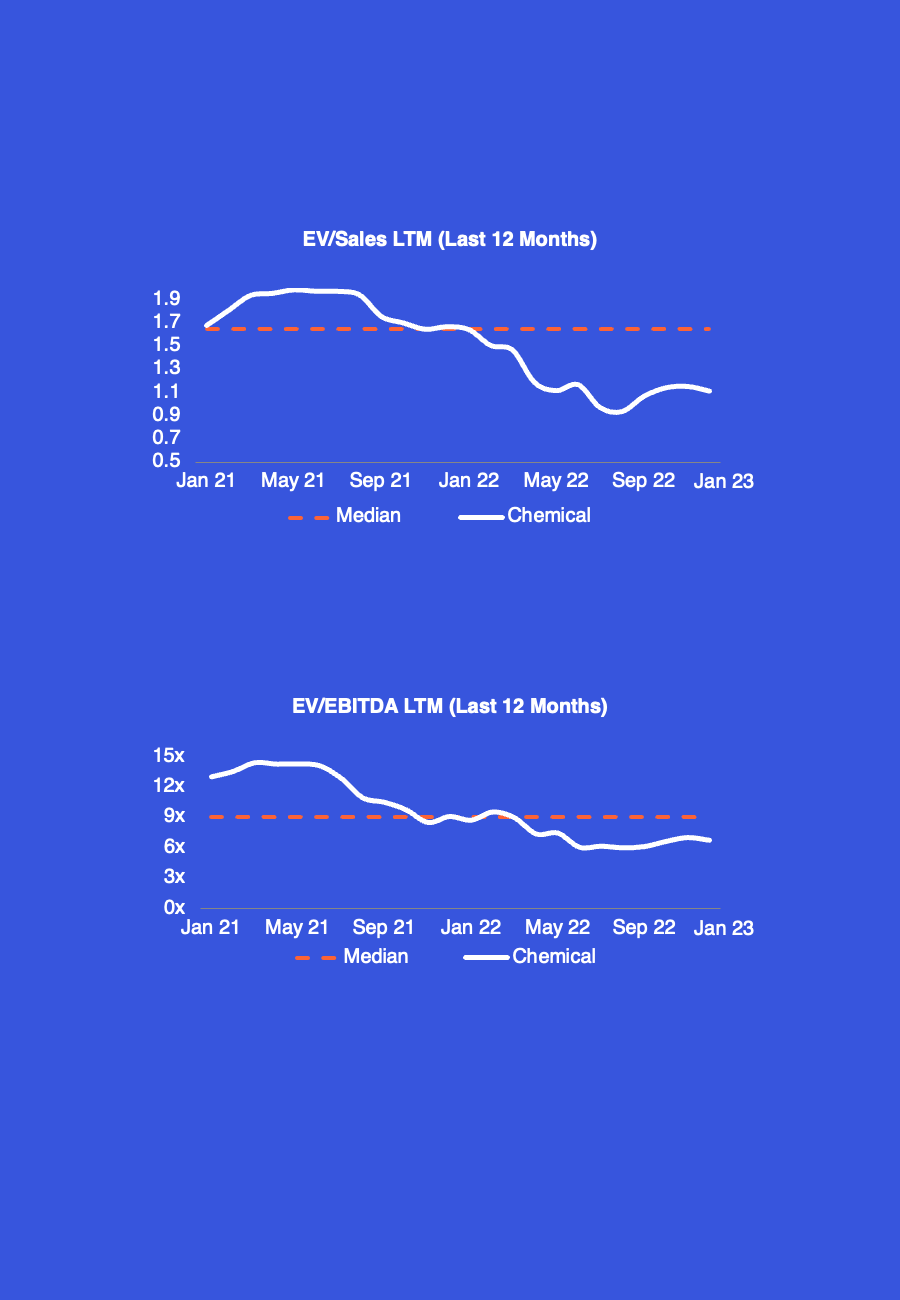

- EV/SALES & EV/EBITDA multiples have decreased over the LTM period due to the consequences of supply chain issues, raw material and energy prices skyrocketing and ongoing uncertainty about the economic outlook of 2023. There is also an accelerated oversupply and imbalances from supply disruptions and demand shocks which leads to the lower valuations. However, most recently valuations started to slowly recover but confidence is not yet restored.

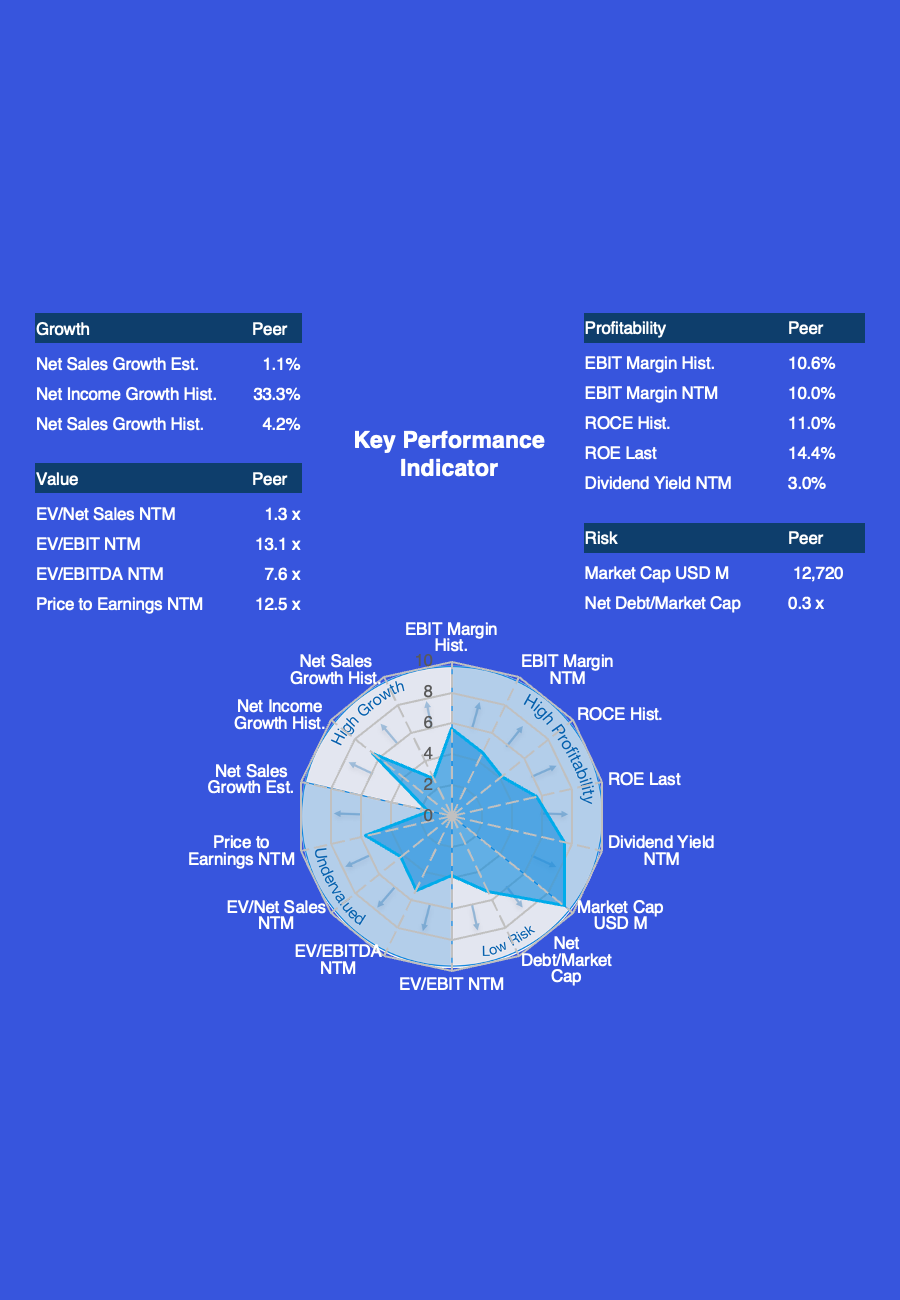

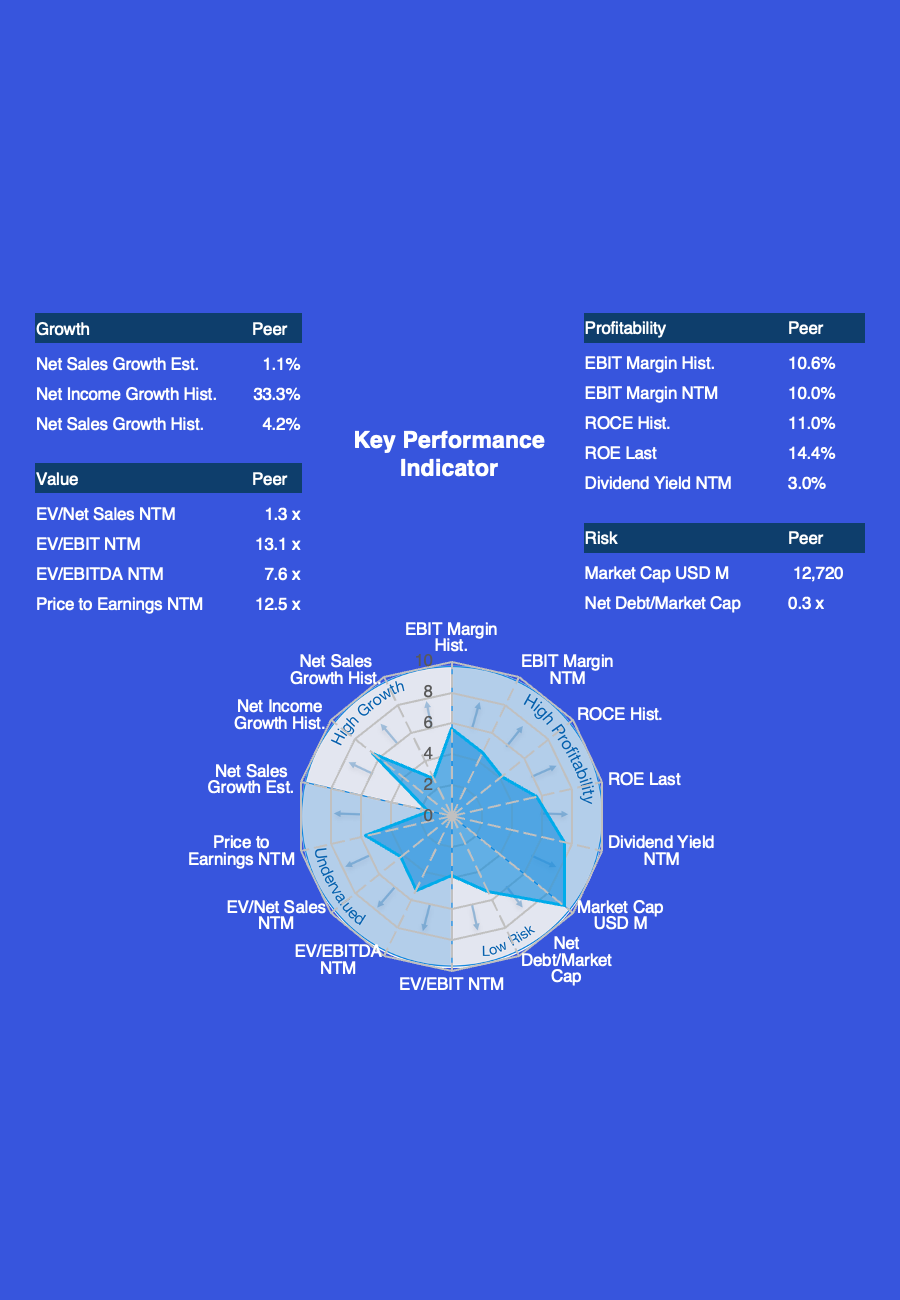

KEY PERFORMANCE INDICATORS

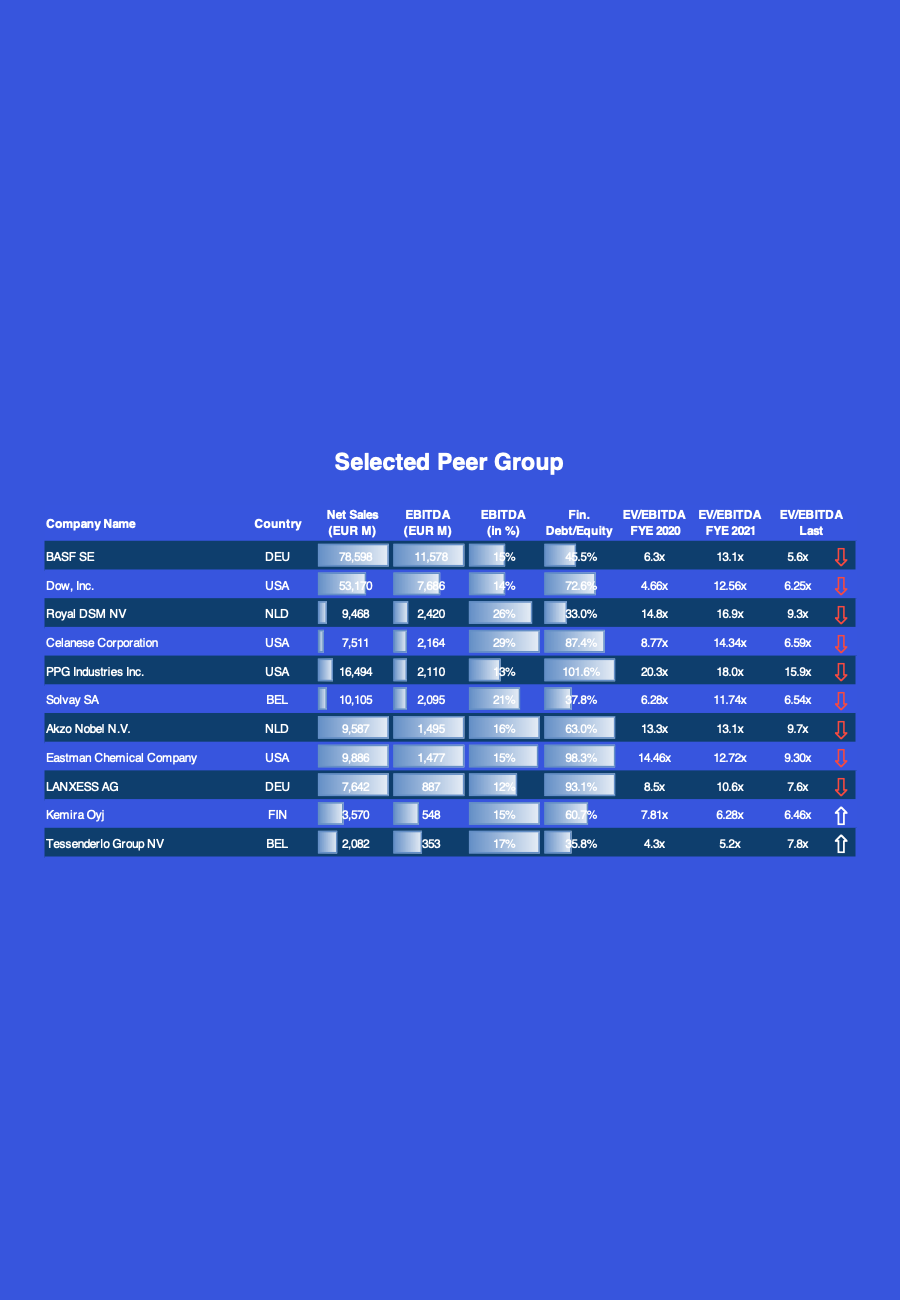

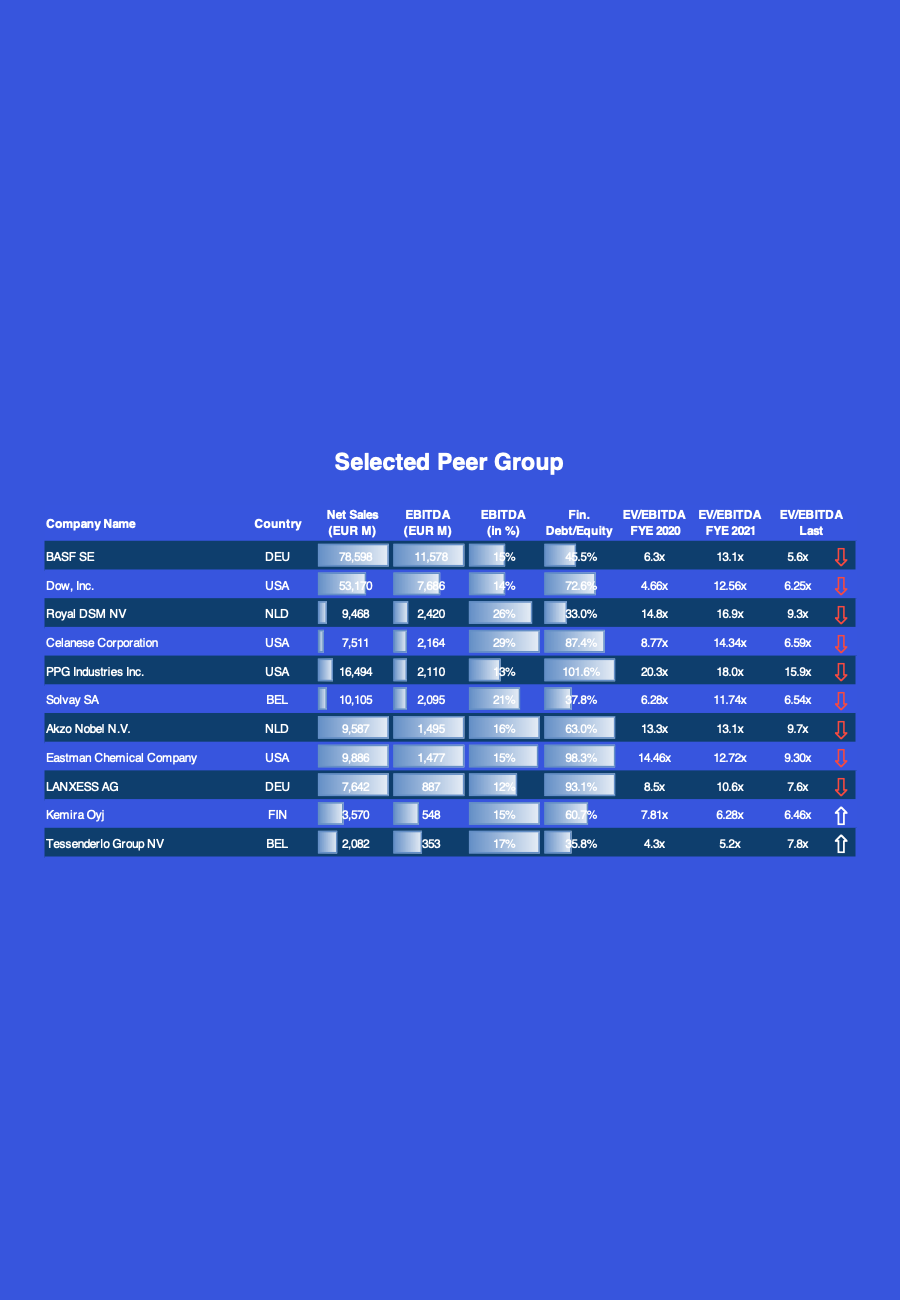

PEER GROUP ANALYSIS

M&A TRANSACTIONS

Selected Deals - Specialty & Intermediate Chemicals

WANT TO KNOW MORE?

If you would like to learn more about the valuations and deals of your industry, the transaction mentioned above, or generally our way of working, we would certainly be happy to demonstrate our m&a PLUS® principle in a confidential meeting. Just get in touch and we will share our experience on how to grow businesses with long-lasting partnerships.