275

Opportunities Researched

77

Companies Approached

13

Management Meetings Held

2

New Partnerships Forged

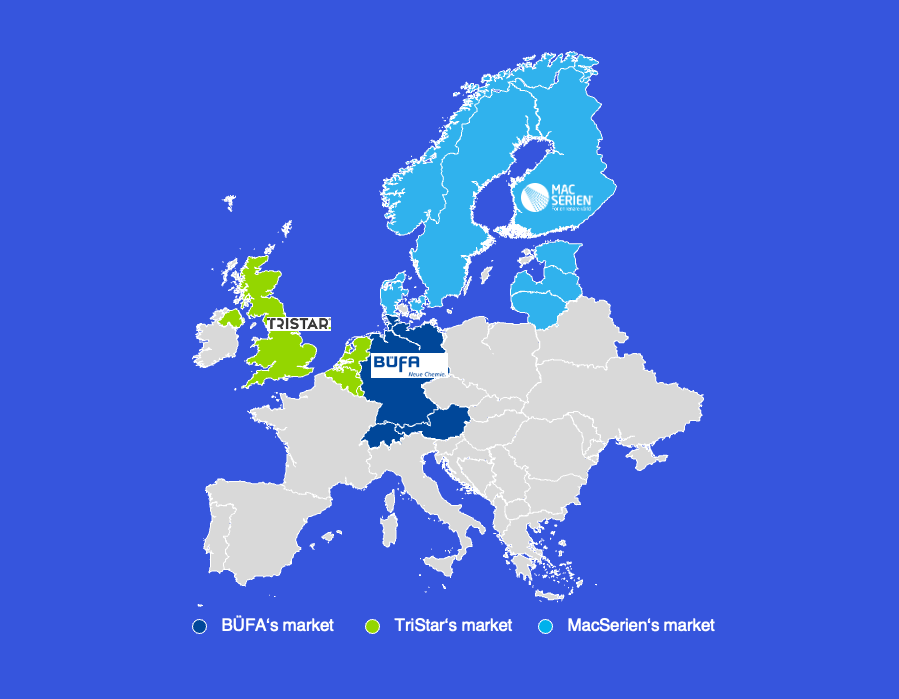

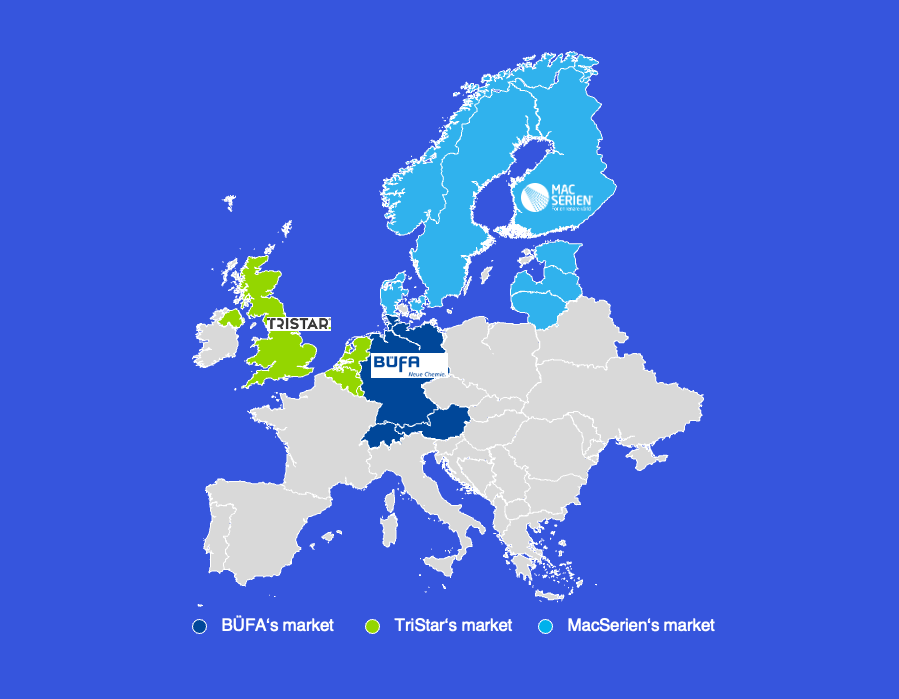

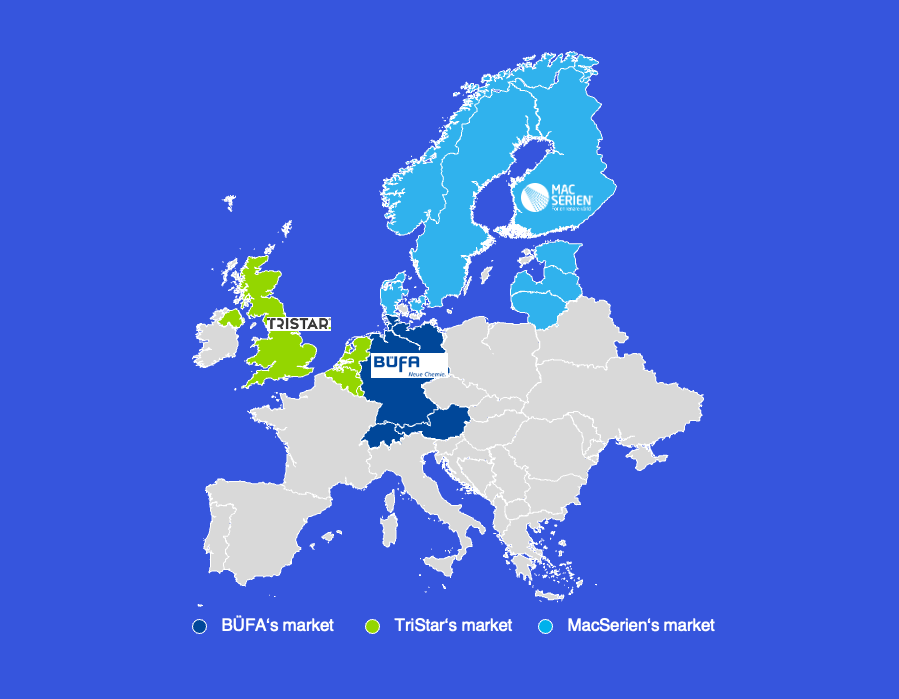

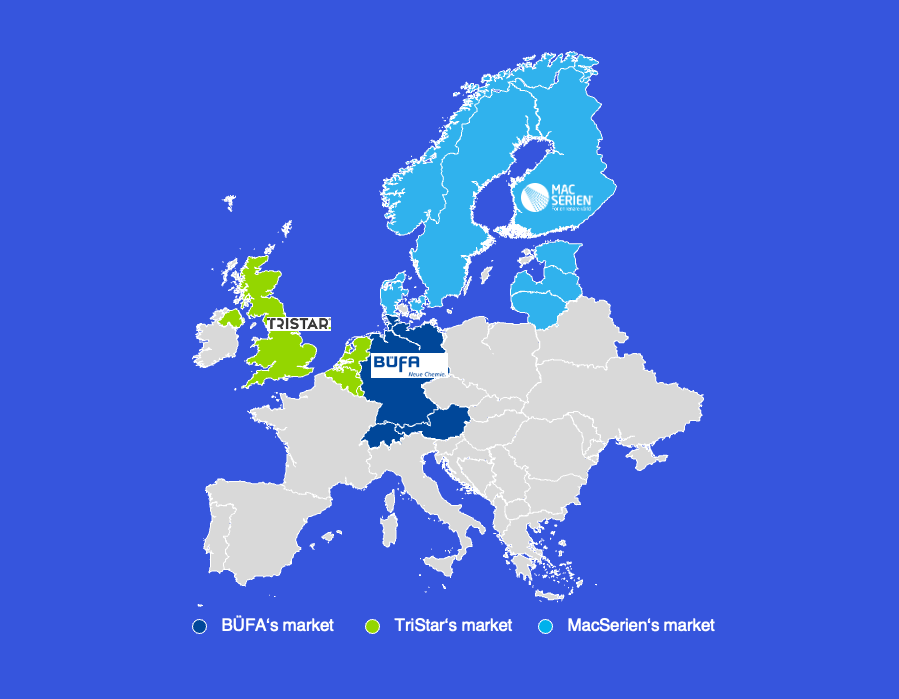

We are proud to announce that we have successfully advised BÜFA Group on the partnership with the Dutch industrial cleaning products producer TriStar Group. In parallel we advised to establish a strategic partnership with the Swedish MacSerien Group, which specialises within cleaning products in water-free chemicals and sustainable water recycling to support a green circular economy. Both companies fit perfectly to BÜFAs company philosophy and strengthen the Cleaning division in becoming a truly European player.

TriStar Group was founded in 1991 and is an established manufacturer of industrial cleaning products in the Netherlands. With locations in the Netherlands and the UK, TriStar serves various industries throughout Europe. The focus is on cleaning systems for the chemical industry, food industry as well as paints, printing inks and adhesives. At the same time, the company specialises in contract manufacturing, private labels and operates a consumer brand called Estelle.

MacSerien manufactures and develops high-quality environmentally friendly cleaning products since its incorporation in 1989. The group has two production sites in Sweden and Estonia. The products are predominantly used in the areas of car care, water treatment, hospitality and various industry segments.

The BÜFA Group is a family owned company in the chemical industry with a tradition of more than 100 years. Founded in Oldenburg in 1883, it is internationally active in the business areas of chemicals, cleaning and composites. In 2020 the Group employs more than 650 employees.

A major strategic advantage of the expansion is that customers can now be served internationally, as sales and technical service are available locally in many countries, now reaching the markets in the DACH region, Benelux, the Scandinavian countries and the Baltics.

Sazun advised BÜFA Group across all the steps of the transaction, including market research, the scouting of opportunities, valuation, the negotiation of the deal structure and the coordination of the due diligence, up to the final closing actions.

Opportunities Researched

Companies Approached

Management Meetings Held

New Partnerships Forged